After a tumultuous 2018, the first half of this year has rewarded investors who had the discipline to stay invested through the correction that closed out last year. The S&P has recovered nearly 27% since the low set on Christmas Eve, and about 20% this calendar year, and we think there is still plenty of room to run.

You can’t turn on the news today without hearing some doom-and-gloom reporting about the economy, but the truth is the data just doesn’t support that sentiment. Fear mongering, it turns out, is a great way to boost ratings, so let’s look at some reasons you shouldn’t be concerned; at least not yet.

Current government policies are extremely conducive to growth. Recent tax cuts, coupled with greatly reduced regulatory impediments, are making it easier and more profitable for companies to do business in the United States. As such, we saw a leap in corporate profits in 2017/18 and we continue to see strong growth today. We expect companies to enjoy an increase in year-over-year profits of roughly 10% this year, and next.

Higher corporate profits mean higher stock prices, which you’ll see reflected in your retirement account statements. Profits also mean companies can and need to keep their workforce employed in order to continue growing. Corporations take those profits and reinvest them into new technologies to make their workforce more efficient, and into the development of new products and new markets. In short, if businesses, from the corner café to the biggest conglomerate, don’t grow, then the economy stagnates.

This year we expect GDP (the measure of all things produced in the US) to increase roughly 3%, which represents a nearly 50% increase in the rate of growth experienced annually between 2009 and 2016, and is largely a reflection of more accommodative government policies.

Wage growth continues to increase and is currently outpacing measures of inflation. This means that, all things being equal, wages are increasing at a rate faster than living expenses, and workers have additional funds to spend or save.

The Fed continues to be extremely loose, and there is even talk about a rate cut which we think is wholly unnecessary.

Consider that interest rates are the price of money. When money is cheap, people and companies are willing to borrow it. When money is expensive, borrowing slows. So, the Fed raises and lowers interest rates in order to help manage the rate of growth; lowering rates to help spur growth, and raising them to rein it in.

There has been some fear that growth may be slowing, and so there has been talk about a possible rate cut. Interestingly, recent data indicates the economy is probably doing just fine, and a cut isn’t necessary. As a result, and counterintuitively, the markets have responded negatively to the positive economic news, which serves as a good reminder that markets aren’t always rational in the short term, and investors should be cautious about reacting to short term volatility.

Barring any kind of unexpected geopolitical event, we think the economy will continue growing for at least the next 18-24 months. Staying focused on the fundamentals is crucial to maintaining growth in your portfolio, and it will be even more important as the political climate begins to heat up, causing additional volatility. Tune out the noise and focus on what matters. If you stayed invested during the 2018 correction, you already know this. If you panicked, then consider the upcoming volatility a second chance.

As always, these statements are forward looking, and are subject to revision at any time, so be sure to work closely with your independent financial advisor to help ensure that your investment portfolio remains appropriate for your needs and market conditions.

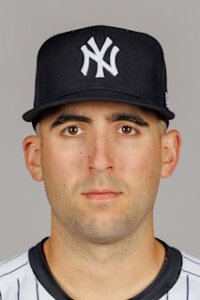

Stephen Kyne, CFP is a Partner at Sterling Manor Financial, LLC in Saratoga Springs, and Rhinebeck. Securities offered through Cadaret, Grant & Co., Inc. Member FINRA/SIPC. Advisory services offered through Sterling Manor Financial, LLC, or Cadaret Grant & Co., Inc., SEC registered investment advisors.Sterling Manor Financial and Cadaret Grant are separate entities.

How to resolve AdBlock issue?

How to resolve AdBlock issue?