SARATOGA SPRINGS — Finance Commissioner Minita Sanghvi proposed a $54.2 million 2023 spending plan for Saratoga Springs during the city’s initial Comprehensive Budget presentation on Oct. 6.

While similar to the $54.1 million 2022 budget, next year’s proposal accounts for 7 percent more in revenues, as the 2022 budget contains $3.9 million of ARPA monies received from the Federal Government, Sanghvi explained.

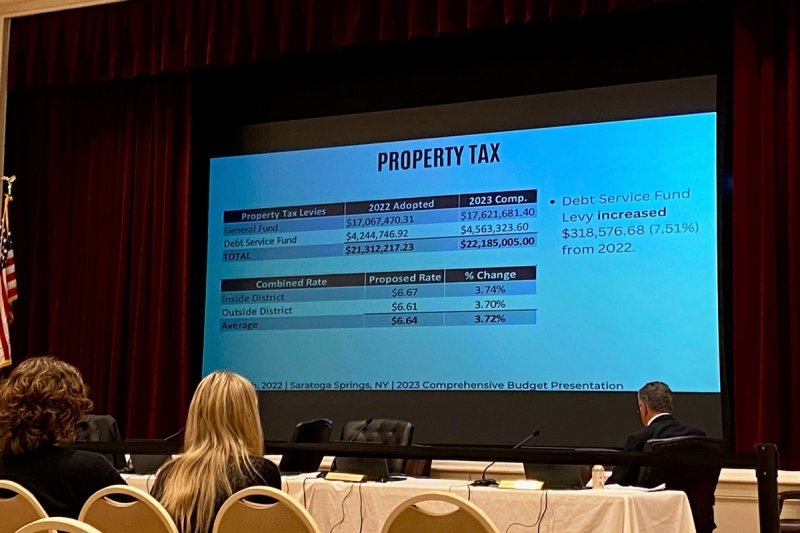

The main sources of revenue were property tax, sales tax, mortgage tax, State aid, and VLT aid, accounting for 75 percent of the city’s revenue.

Employee salaries, benefits and insurance costs account for 84 percent of the city’s expenses, with the rising cost of healthcare, retirement benefits, and insurance being the main sources of strain on next year’s expenses.

The budget includes the addition of 16 new fire fighters for the 3rd EMS/ Fire Station under development on Henning Road. While these new additions will be paid for by a Federal SAFER grant, the grant only pays for personnel and benefits costs and would not cover the day-to-day operations, uniforms, medical exams, equipment, and other various costs of the fire station, Sanghvi said.

To balance these costs Sanghvi proposed raising Real Property Tax from $6.43 to $6.67 for the Inside District, and from $6.37 to $6.61 for the Outside District; an average increase of 3.72 percent.

“This means if your house is assessed at $200,000 you will pay $4 a month more on your property tax. If your house is assessed at $300,000 you will pay $6 a month more on your property tax. If your house is assessed at $400,000 you will pay $8 a month more on your property tax,” Sanghvi said.

A series of workshops – one for each city department – are scheduled to take place this month at City Hall. Upcoming workshops include: Public Works & Recreation (11 a.m., Oct. 17); Public Safety (3 p.m., Oct. 24); Capital Budget (4 p.m., Oct. 26), and Summary of Amended Budget (3 p.m. Oct. 28).

The public will have the opportunity to comment on the budget during a 2023 Comprehensive Budget Public Hearing at 6:45 p.m. on Tuesday, Oct. 18.

How to resolve AdBlock issue?

How to resolve AdBlock issue?