Social Security is a hot-button topic that many people don’t quite know enough about. What people do know, however, makes them worried. You’re constantly hearing that the system is underfunded and, for obvious reasons, that makes many concerned about whether or not it will be there to pay benefits when the time comes.

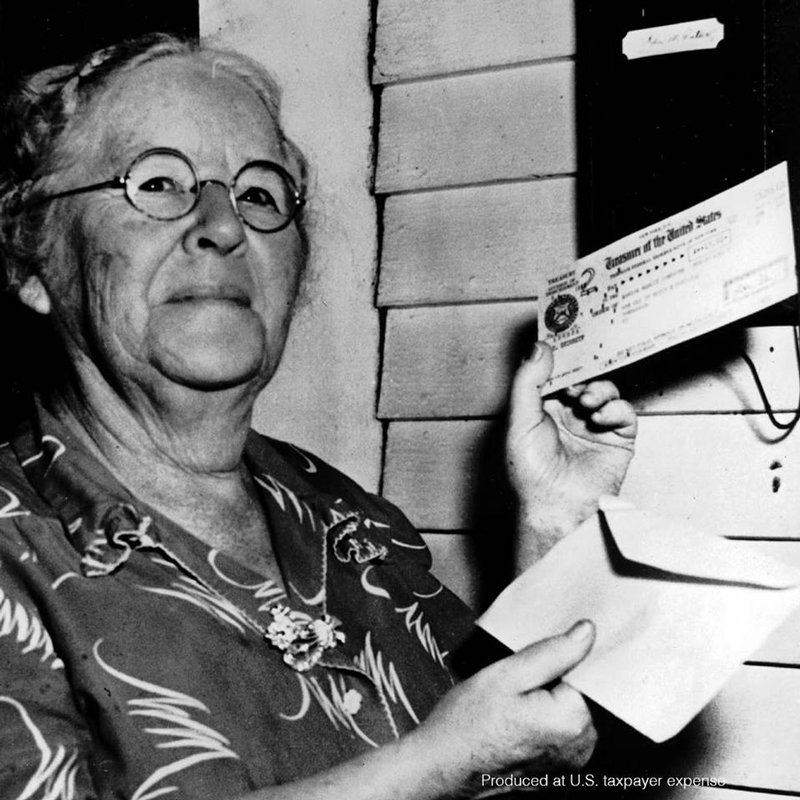

This is the story of the very first recipient of Social Security retirement benefits. You’ll notice some flaws in the system from the beginning.

Miss Ida May Fuller, or “Aunt Ida,” as she was known, was born outside of Ludlow, Vermont on September 6, 1874. She attended school with Calvin Coolidge in Rutland, and would later work as a school teacher and a legal secretary. Ida May lived alone for most of her life, had no children, and never married.

On November 4, 1939, at the ripe old age of 65, she had been contributing to the Social Security system for just shy of three years. While out and about, she stopped by the Rutland Social Security office to find out about possible benefits. “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it,” Ida is quoted as having said.

Her claim was taken by the clerk in Rutland, and transmitted to Washington, D.C. to be certified. On January 31, 1940, Ida May Fuller received check number 00-000-001, in the amount of $22.54.

Ida May lived to be 100-years-old, dying in 1975, and started collecting benefits at age 65. Over that time, she collected a total of $22,888.92. Her total lifetime contributions to the Social Security system: $24.75!

So, here are some take-aways.

1. You’re probably going to live longer than you expect. When Ida May was born, her life expectancy certainly was not 100 years, and neither was yours. Advancements in medicine and technology mean that you will almost certainly outlive your current life expectancy. Are you planning for your income and assets to last that long? Do you think the system can afford to pay recipients a 40 year pension, based on contributions they’ve made for as few as 10 years (forty quarters, which is the current minimum)?

2. Ida May received far more in benefits than she ever contributed to the Social Security system, and, most likely, so will you. Ida recouped all of her personal contributions in a little over a month of receiving her benefits. For you, it will take four or five years. Find a copy of your current Social Security statement, and look at page 3. There you will find a tally of your total personal contributions (as well as those contributions your employer made on your behalf – be sure to thank him or her, since that was money from their pocket).

How can benefits at this level be sustainable when you recoup your contributions so quickly? The system works by taking money from current workers, and giving it to current recipients. There is no box with your name on it in Washington, D.C., that holds your personal contributions: it’s a cash-in, cash-out system. When Social Security began, workers outnumbered recipients 10:1. Today that ratio has shrunk to 3:1. Clearly, in order for the system to continue to function, some changes must be made.

Low contribution amounts over a limited working life are somehow expected to entitle you to a relatively rich retirement benefit amount for an indefinite lifetime. In many ways, the system has been broken from the beginning. What does this mean for you? While we don’t expect Social Security to disappear, we do expect it to look a little different in the future. It has to, if it is to continue.

Higher retirement ages:

Since the government cannot tell you when to die, the only option is has for shortening your benefit period is to increase your eligibility age. Like it or not, this is a pretty sure bet for younger workers. Traditionally, drastic changes to eligibility aren’t made which affect those already collecting, or who will be collecting soon.

Higher contribution limits:

Currently income above $132,900 is not taxed for Social Security purposes. Expect to see that figure continue to increase so that more contributions are available to pay current benefits.

Means testing:

If you consider that a portion of your Social Security benefits are already taxable if your income is beyond certain limits, which have not been adjusted in many, many years, then means testing is already here. Expect benefits to continue to be decreased for those of more substantial means.

Be sure to work with your financial advisor to plan a retirement that includes Social Security benefits, whatever those may be, but which supplements those benefits with income from your investments as well. Being proactive will help to ensure you make the most of Social Security, no matter how it may change in the future.

Stephen Kyne, CFP is a partner at Sterling Manor Financial in Saratoga Springs and Rhinebeck. Securities offered through Cadaret, Grant & Co., Inc. Member FINRA/SIPC. Advisory services offered through Sterling Manor Financial, LLC, or Cadaret Grant & Co., Inc., SEC registered investment advisors. Sterling Manor Financial and Cadaret Grant are separate entities.

How to resolve AdBlock issue?

How to resolve AdBlock issue?